Life Insurance In Dallas Tx Fundamentals Explained

Wiki Article

Getting My Commercial Insurance In Dallas Tx To Work

Table of ContentsTruck Insurance In Dallas Tx Things To Know Before You Get ThisHealth Insurance In Dallas Tx Things To Know Before You Get ThisHome Insurance In Dallas Tx - An OverviewThe 9-Minute Rule for Home Insurance In Dallas TxThe Definitive Guide for Home Insurance In Dallas TxThings about Home Insurance In Dallas Tx

As well as given that this protection lasts for your whole life, it can assist sustain lasting dependents such as children with handicaps. Con: Cost & intricacy a whole life insurance policy plan can be substantially extra costly than a term life plan for the exact same fatality advantage amount. The cash worth element makes whole life extra intricate than term life as a result of fees, tax obligations, passion, and other terms.

Riders: They're optional add-ons you can make use of to tailor your plan. Some policies include riders automatically included, while others can be included at an extra expense. Term life insurance policy plans are typically the most effective remedy for individuals who require economical life insurance policy for a details period in their life.

Fascination About Life Insurance In Dallas Tx

" It's constantly suggested you consult with an accredited agent to determine the most effective option for you." Collapse table Since you're acquainted with the basics, below are added life insurance policy kinds. Several of these life insurance policy alternatives are subtypes of those featured over, implied to serve a particular purpose.Pro: Time-saving no-medical-exam life insurance policy provides much faster access to life insurance coverage without having to take the clinical exam., likewise recognized as volunteer or voluntary extra life insurance policy, can be made use of to bridge the protection void left by an employer-paid team plan.

Unlike various other plan kinds, MPI just pays the survivor benefit to your home loan lending institution, making it a far more limited choice than a conventional life insurance policy policy. With an MPI policy, the recipient is the mortgage business or lender, rather than your family members, and the fatality advantage reduces gradually as you make home mortgage settlements, similar to a decreasing term life insurance policy policy.

What Does Commercial Insurance In Dallas Tx Mean?

Because AD&D just pays under particular situations, it's not an ideal replacement for life insurance policy. AD&D insurance coverage just pays out if you're harmed or killed in a mishap, whereas life insurance policy pays out for the majority of reasons of fatality. Due to this, AD&D isn't appropriate for everyone, however it might be advantageous if you have a risky occupation.

Getting The Health Insurance In Dallas Tx To Work

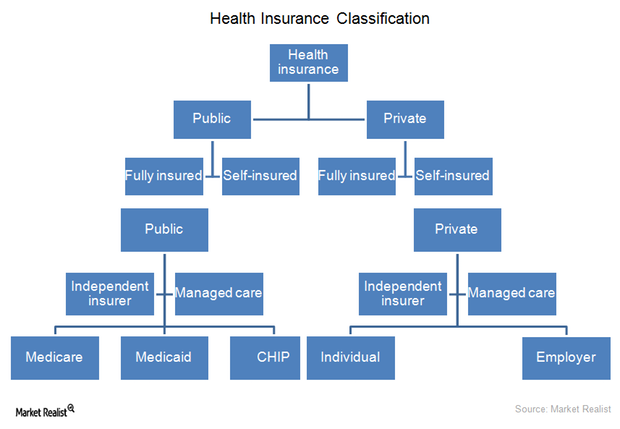

click to find out more Best for: Pairs who do not qualify for 2 private life insurance policy policies, There are two major types of joint life insurance policy plans: First-to-die: The policy pays out after the initial of the 2 spouses dies. First-to-die is the most similar to a specific life insurance policy plan. It assists the enduring insurance holder cover costs after the loss of financial backing.What are the two major kinds of life insurance policy? Term and long-term are the two primary kinds of life insurance.

Both its period as well as cash money worth make long-term life insurance coverage many times extra pricey than term. Term life insurance policy is usually the most affordable and extensive type of life insurance because it's easy and also supplies economic security throughout your income-earning years.

Unknown Facts About Truck Insurance In Dallas Tx

Whole, global, indexed global, variable, as well as interment insurance coverage are all types of long-term life insurance coverage. Long-term life insurance generally comes with a cash value and has greater costs.life insurance coverage market in 2022, according to LIMRA, the life insurance policy research study company. Term life premiums stood for 19% of the market share in the very same period (bearing in mind that term life costs are much less expensive than whole life costs).

There are four standard components to an insurance contract: Statement Page, Insuring Arrangement, Exemptions, Conditions, It is vital to comprehend that multi-peril policies might have particular exclusions and also conditions for each kind of protection, read such as crash protection, medical settlement insurance coverage, liability protection, and so forth. You will need to make certain that you review the language for the particular insurance coverage that relates to your loss.

Our Life Insurance In Dallas Tx Ideas

g. $25,000, $50,000, etc). This is a summary of the major assurances of the insurance provider and states what is covered. In the Insuring Agreement, the insurance firm concurs to do specific points such as paying losses for protected dangers, supplying specific solutions, or concurring to protect the insured in a responsibility claim.i loved this Instances of omitted residential property under a house owners policy are personal effects such as an automobile, an animal, or an airplane. Problems are provisions placed in the policy that certify or place restrictions on the insurance company's pledge to pay or perform. If the plan conditions are not satisfied, the insurer can reject the case.

Report this wiki page